Is the outlook exciting for AGL shares in November?

Image source: Getty Images

You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing Services. Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources, and more. Learn More

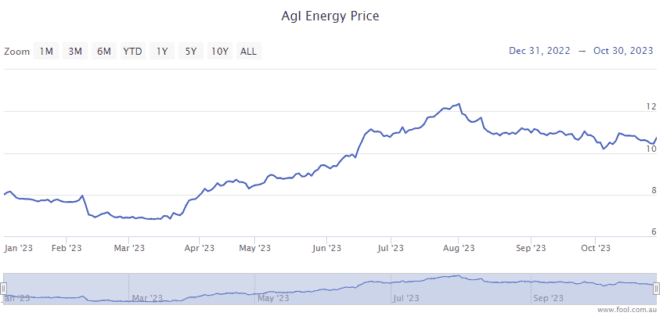

The AGL Energy Ltd (ASX: AGL) share price has fallen 12% from 1 August 2023. Despite that, the AGL share price is still up by around 34% since the start of 2023, as shown in the chart below. Should investors still be excited about the company?

The ASX energy share has seen a significant turnaround in profitability, driving a good rise in investor confidence in the company.

Latest outlook commentaryIn its FY23 result, AGL maintained its underlying earnings guidance range.

Underlying earnings before interest, tax, depreciation and amortisation (EBITDA) could rise to between $1.875 billion and $2.175 billion. Underlying net profit after tax (NPAT) could double to $580 million at least and reach as much as $780 million.

There are two key reasons for the anticipated increase in AGL's earnings in FY24.

First, the company noted sustained periods of higher wholesale electricity pricing, reflected In "pricing outcomes and reset through contract positions."

The other key factor is that it's expecting improved plant availability and flexibility of the asset fleet, including the start of operations of the Torrens Island and Broken Hill batteries and the non-recurrence of forced outages and market volatility impacts from July 2022.

Broker UBS likes the ASX energy share.

UBS suggests that energy prices could stay strong because of several factors. These include the potential exit of some/all of Origin Energy Ltd's (ASX: ORG) Eraring Power Station capacity in mid-2025, warmer weather associated with a forecast El Nino weather system and lower generation availability from competitors.

UBS is forecasting that earnings before interest and tax (EBIT) could rise by 8% in FY25 compared to its estimate for FY24, thanks to stronger electricity margins and a full year of additional capacity from the Rye Park wind farm.

The broker said that if AGL could continue to improve generation availability and "reliably maintain the flexibility now possible at Bayswater and Loy Yang power stations", it could provide "further upside" to UBS' outlook.

Looking at the UBS estimate, it's projected to generate $1 of earnings per share (EPS) in FY24 and $1.12 in FY25.

If those projections are correct, it would put the AGL share price at 11x FY24's estimated earnings and under 10x FY25's.

UBS currently rates UBS as a buy, with a price target of $12.15. That implies a possible rise of 12% over the next year, though that's just the broker's guess.

Energy Shares Up 58% in a week. Why is this ASX All Ords share exploding?

October 30, 2023 | James Mickleboro

Why are investors fighting to get hold of this energy share?

Read more »

Energy Shares The oil price is down 9% in a month. How are ASX 200 energy shares holding up?

October 27, 2023 | Bernd Struben

International benchmark Brent crude oil prices slid 2.4% overnight to US$87.93 per barrel.

Read more »

October 26, 2023 | Bronwyn Allen

Whitehaven has failed to block the voting rights of a UK hedge fund manager at today's AGM.

Read more »

Opinions The Woodside share price is down 6% in a week. Is it a buy right now?

October 26, 2023 | Tristan Harrison

Is an opportunity building with the valuation falling?

Read more »

Energy Shares 3 directors buy Whitehaven shares following news of BHP coal mines acquisition

October 25, 2023 | Bronwyn Allen

It's considered a positive sign when directors invest more of their own money in the companies they run.

Read more »

Energy Shares Why is the Ampol share price zooming higher today?

October 25, 2023 | James Mickleboro

Ampol has delivered the goods during the third quarter. Here's how profitable it has been.

Read more »

Energy Shares Santos shares marching higher despite latest risk to $5.7 billion gas project

October 24, 2023 | Bernd Struben

Santos shares would likely face some stiff tailwinds if its Barossa project was derailed at this late stage of the…

Read more »

Energy Shares Why is the New Hope share price crashing 9% today?

October 23, 2023 | James Mickleboro

What's going on with this coal miner's shares on Monday?

Read more »