Why Nvidia Stock Crashed on Monday

A perfect storm buffeted the chipmaker to kick off the week.

Shares of Nvidia (NVDA -6.16%) were under pressure on Monday, falling as much as 15.5%. As of 10:46 a.m. ET today, the stock was still down 7.3%.

The catalysts that sent the chipmaker lower were a combination of dismal market conditions and reports that its next-generation artificial intelligence (AI) processor might be delayed.

Delay of game?It's no secret that Nvidia's graphics processing units (GPUs) have been the foundation upon which the AI revolution was built. A report that emerged over the weekend suggested that the company has had a rare fumble.

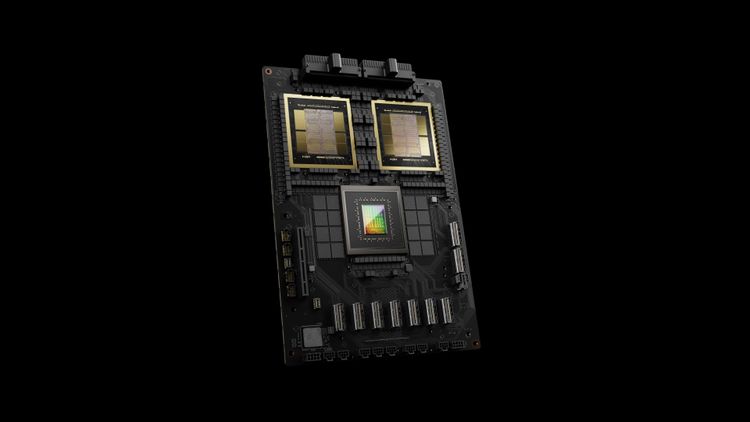

Nvidia's next-generation Blackwell B200 AI processor, which was due to begin shipping later this year, will be delayed by three months due to a design flaw, according to a report that first appeared on the website The Information.

The company reportedly told its biggest customers, including Microsoft, that the issue was discovered late in the production process, which could ultimately delay the launch. Some market pundits suggest the delay could cost Nvidia billions of dollars in additional revenue. The company countered, saying production is on track to ramp up later this year.

Adding insult to injury, analysts at Citi removed Nvidia stock from the investment bank's "upside catalyst watch," though it maintained a buy rating and $150 price target. This represents potential upside of 40% compared to Friday's closing price.

Lastly, the overall market meltdown, seemingly caused by the Bank of Japan rate hike, didn't help, sending fair-weather investors running for cover.

Not all doom and gloomHowever, many on Wall Street don't think the sky is falling.

Analysts at Bank of America maintained a buy rating and $150 price target on the stock and called it a top sector pick heading into Nvidia's second-quarter report, scheduled for Aug. 28. They went on to say that any weakness in the shares is an "enhanced buying opportunity" as demand remains strong.

It's still early days for the adoption of generative AI, and Nvidia is arguably in the best position to profit from this trend. Furthermore, while it sells for roughly 37 times forward earnings, its triple-digit revenue and profit growth justify the slight premium. That's why Nvidia stock is a buy.

Citigroup is an advertising partner of The Ascent, a Motley Fool company. Bank of America is an advertising partner of The Ascent, a Motley Fool company. Danny Vena has positions in Microsoft and Nvidia. The Motley Fool has positions in and recommends Bank of America, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.