Nvidia Stock Down After Hours Despite Q2 Earnings Beat And Raise

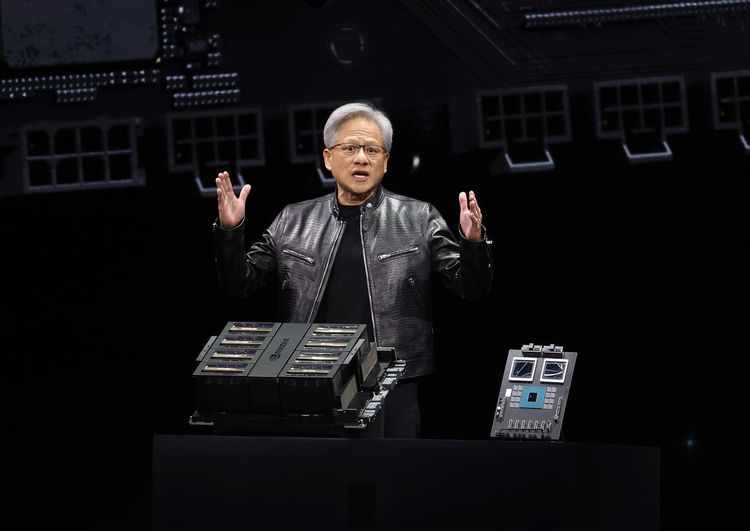

SAN JOSE, CALIFORNIA - MARCH 18: Nvidia CEO Jensen Huang delivers a keynote address during the ... [+] Nvidia GTC Artificial Intelligence Conference at SAP Center on March 18, 2024 in San Jose, California. The developer conference is expected to highlight new chip, software, and AI processor technology. (Photo by Justin Sullivan/Getty Images)

Getty ImagesNvidia reported earnings after the bell that exceeded Wall Street expectations for earnings and guidance, and provided stronger-than-expected guidance for the current quarter, CNBC noted.

Here are the key numbers:

Q2 2024 revenue: $30.4 billion — up 125% from the year before and $700 million more than analysts’ consensus of $28.7 billion for the quarter ending July 31, according to London Stock Exchange Group. Data center revenue: $26.3 billion — up 154% from the year before and $1.1 billion more than StreetAccount expectations. Q2 2024 net income: $16.6 billion — up 168% from the year-ago period, noted CNBC. Q2 2024 adjusted earnings per share: 68 cents — up 152% from the year before and four cents per share more than the analyst consensus of $0.64, according to SeekingAlpha. Q3 2024 revenue guidance: $32.5 billion — up 80% from the year before and $700 million more than the $31.7 billion analysts’ consensus, according to CNBC.Demand for Nvidia’s Blackwell chips is “incredible,” CEO Jensen Huang said in a press release. “Global data centers are in full throttle to modernize the entire computing stack with accelerated computing and generative AI,” he added.

Nvidia said it shipped samples of Blackwell chips during the quarter, and made a change to the product to make it more efficient to manufacture. “In the fourth quarter, we expect to ship several billion dollars in Blackwell revenue,” Nvidia CFO Colette Kress wrote in a statement.

Nvidia said product issues resulted in a decline in gross profit margins between the first and second quarters of 2024, noted the Wall Street Journal. More specifically, the company’s second quarter gross margin of 75.1% declined 3.3 percentage points from the previous period.

For the full fiscal year, Nvidia expects gross margins to be in the “mid-70% range” — slightly below the StreetAccount consensus of 76.4%, CNBC reported.

Nvidia also expects Hopper, the company’s current-generation chip, to increase total shipments for the next two quarters.

Nvidia said it approved $50 billion in share buybacks.In a statement, according to CNBC.

While Nvidia’s results are impressive — the company’s growth is slowing down. For example, the AI chip designer’s earnings growth grew at an average of 500% while the company’s revenues grew in a range of 206% to 265%, during the previous three quarters, according to Investor’s Business Daily.

Nvidia’s forecast of 80% revenue growth in the third quarter represents a marked slowdown from the previous pace.

This post will be updated following Nvidia’s investor conference call.

Follow me on Twitter or LinkedIn. Check out my website or some of my other work here.