30-Year Mortgage Rates Holding Near Two-Week Low

Editor's Note: Investopedia will not publish daily mortgage rate news on Thursday, Nov. 28, in observance of Thanksgiving. We will return to our daily rate coverage on Friday, Nov. 29.

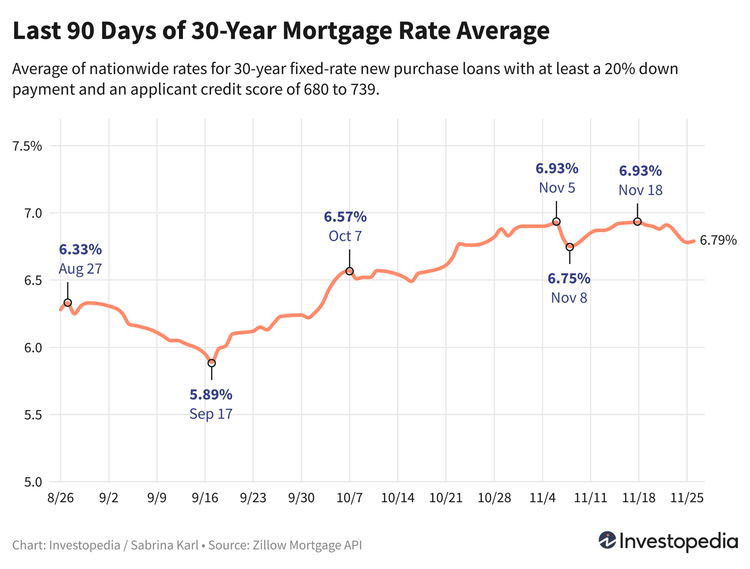

After wavering in an elevated range for two weeks, 30-year mortgage rates fell dramatically Monday—and then remained near that lower level Tuesday. Now down to an average of 6.79%, that's notably below a recent four-month high of 6.93%. Rate movement was mixed for other mortgage types Tuesday.

Because rates vary widely across lenders, it's always smart to shop around for your best mortgage rate and compare rates regularly, no matter the type of home loan you seek.

Today's New Purchase Mortgage Rate AveragesRates on 30-year new purchase mortgages ticked up a single basis point Tuesday, leaving the flagship average at 6.79% after a drop of 13 points Monday. Rates had previously been bobbing in a narrow yo-yo pattern that touched a four-month high of 6.93%.

While mortgage rates had plunged to a 2-year low in September, they roared back in October and have been wavering in higher territory this month. Today's average is 90 basis points above the two-year low registered on Sept. 17—when the 30-year average plummeted to 5.89%.

But looking further back, 30-year mortgage rates remain far below an April peak of 7.37%. They are also about 1.2 percentage points cheaper than the historic 23-year peak of 8.01% last October.

Rates on 15-year mortgages slid 1 basis point lower, reducing Tuesday's average to 5.96%. Like 30-year loans, 15-year rates sank to a two-year low in September, dropping as far as 4.97%. Though today's 15-year rates are elevated, they remain more than 1.1 percentage points below last fall's historic 7.08% reading—a high since 2000.

Jumbo 30-year mortgage rates meanwhile dipped 2 basis points Tuesday, lowering the average to 6.81%. That's well below a recent three-month high of 6.99%. In September, jumbo 30-year rates had sunk to 6.24%, their lowest average in 19 months. Although daily historical jumbo rates weren't published before 2009, it's estimated that the 8.14% peak we saw last fall was the most expensive jumbo 30-year average in 20-plus years.

Every Thursday, Freddie Mac, a government-sponsored buyer of mortgage loans, publishes a weekly average of 30-year mortgage rates. This week's reading fell 3 basis points to a weekly average of 6.81%, while as recently as Sept. 26, the average sank to a two-year low of 6.08%. Last October, Freddie Mac's average moved the other way, surging to a historic 23-year peak of 7.79%.

Freddie Mac’s average differs from what we report for 30-year rates because Freddie Mac calculates a weekly average that blends five previous days of rates. In contrast, our Investopedia 30-year average is a daily reading, offering a more precise and timely indicator of rate movement. In addition, the criteria for included loans (e.g., amount of down payment, credit score, inclusion of discount points) varies between Freddie Mac's methodology and our own.

Calculate monthly payments for different loan scenarios with our Mortgage Calculator.

The rates we publish won’t compare directly with teaser rates you see advertised online since those rates are cherry-picked as the most attractive vs. the averages you see here. Teaser rates may involve paying points in advance or may be based on a hypothetical borrower with an ultra-high credit score or for a smaller-than-typical loan. The rate you ultimately secure will be based on factors like your credit score, income, and more, so it can vary from the averages you see here.

Mortgage rates are determined by a complex interaction of macroeconomic and industry factors, such as:

The level and direction of the bond market, especially 10-year Treasury yields The Federal Reserve's current monetary policy, especially as it relates to bond buying and funding government-backed mortgages Competition between mortgage lenders and across loan typesBecause any number of these can cause fluctuations simultaneously, it's generally difficult to attribute the change to any one factor.

Macroeconomic factors kept the mortgage market relatively low for much of 2021. In particular, the Federal Reserve had been buying billions of dollars of bonds in response to the pandemic's economic pressures. This bond-buying policy is a major influencer of mortgage rates.

But starting in November 2021, the Fed began tapering its bond purchases downward, making sizable reductions each month until reaching net zero in March 2022.

Between that time and July 2023, the Fed aggressively raised the federal funds rate to fight decades-high inflation. While the fed funds rate can influence mortgage rates, it doesn't directly do so. In fact, the fed funds rate and mortgage rates can move in opposite directions.

But given the historic speed and magnitude of the Fed's 2022 and 2023 rate increases—raising the benchmark rate 5.25 percentage points over 16 months—even the indirect influence of the fed funds rate has resulted in a dramatic upward impact on mortgage rates over the last two years.

The Fed maintained the federal funds rate at its peak level for almost 14 months, beginning in July 2023. But on Sept. 18, the central bank announced the first rate cut in what's expected to be a series of decreases in 2024 and likely 2025. This first reduction was by 0.50 percentage points.

On Nov. 7, the Fed announced an additional rate cut of 0.25 percentage points, bringing the federal funds rate to 4.5% to 4.75%. With this cut, the fed funds rate reaches its lowest level since March 2023.

The Fed's next rate announcement will be made Dec. 18.

How We Track Mortgage RatesThe national and state averages cited above are provided as is via the Zillow Mortgage API, assuming a loan-to-value (LTV) ratio of 80% (i.e., a down payment of at least 20%) and an applicant credit score in the 680–739 range. The resulting rates represent what borrowers should expect when receiving quotes from lenders based on their qualifications, which may vary from advertised teaser rates. © Zillow, Inc., 2024. Use is subject to the Zillow Terms of Use.